Adding a Delivery Promise

While communicating a delivery date after a customer makes an online purchase is a basic ecommerce interaction, starting the estimation process and providing a clear delivery promise before the final buying decision (in real-time) is much more difficult.

This playbook explores how enterprise shippers, ecommerce businesses, and marketing leads can increase cart conversion rates by merchandising delivery dates.

Key highlights:

- A delivery promise showing when customers will receive items before purchase significantly increases cart conversion rates.

- Major retailers like Amazon, Walmart, and Target have successfully implemented delivery promises as a competitive advantage.

- Creating accurate delivery estimates requires real-time integration between inventory, fulfillment, transit systems, and shipping policies.

- Shipium's API allows enterprise shippers to confidently display precise delivery dates on product pages and in checkout flows.

Providing a promised delivery date can drive purchase decisions

Consumers expect to be told when they will receive the things they buy online. Traditionally, that is managed after an order is processed, with notifications being sent via email during the post-order flow. But increasingly, buyers are making purchase decisions based on knowing an estimated delivery date before they actually buy something.

A study of VML showed that 63% of shoppers agreed with the statement, with a clear and seamless delivery experience being a crucial aspect of their decision to click the buy now button

Not many stores adhere to this preference. Visit most ecommerce sites and go to the product detail page, and you will see something like “Usually ships within 2 days,” which doesn’t help. All the consumers care about is when they will get the product, but instead, sites give a service level agreement (SLA) for the fulfillment center.

This is a great example of focusing on what’s easy to implement over what actually matters to the customer.

Examples of delivery promises from large ecommerce brands

Large ecommerce businesses — like Walmart, Target, Amazon, Home Depot, and others — have invested in delivery promises, however, and pushed this expectation over the years because they know it matters to customers. Let's take a look.

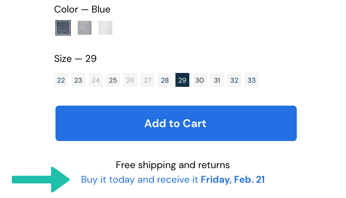

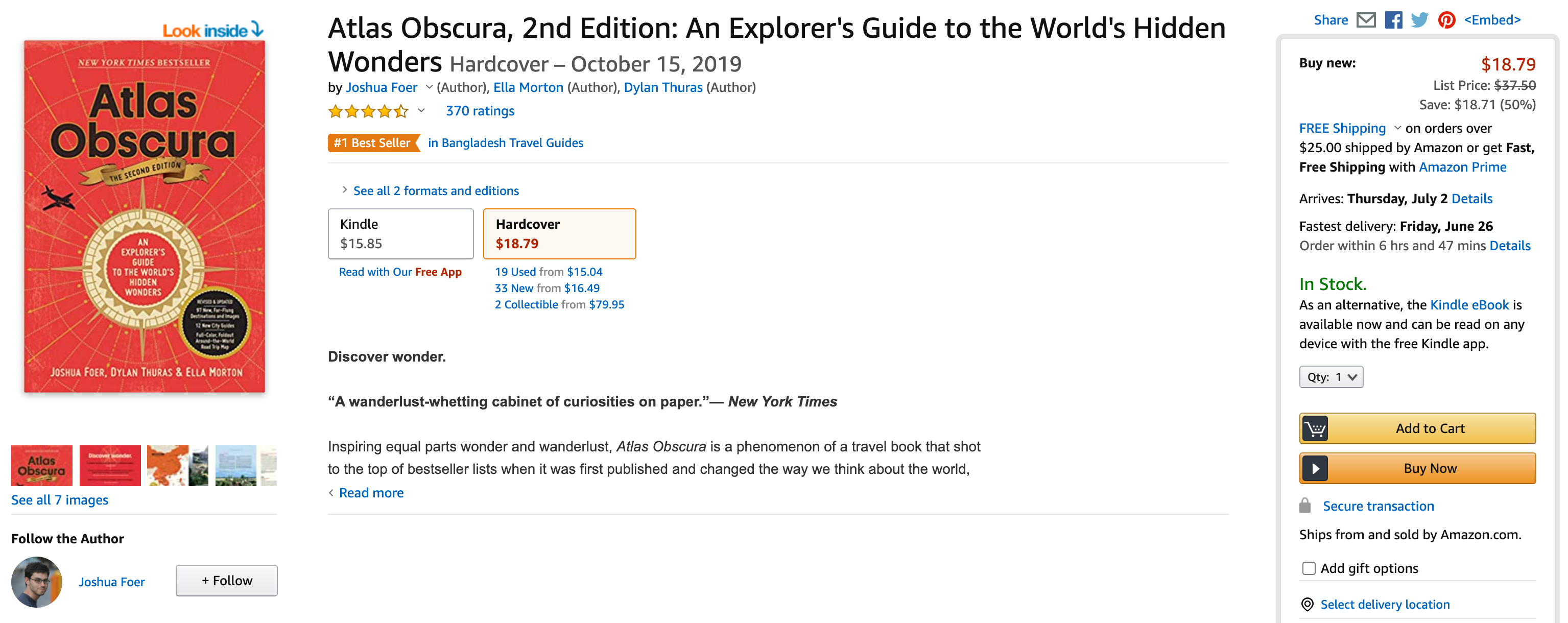

Here we have an example of Amazon showing estimated delivery dates. They went so far as to position it as a promise, showing the fastest shipping time available. Recent advancements also have an "Order by" timing mechanism down to the minute.

Once Amazon expanded to a marketplace model, they extended estimated delivery dates to sellers who use Fulfillment By Amazon (FBA). Here is an example of a seller who uses FBA which affords them the same customer experience benefit of showing accurate EDDs on the product detail page.

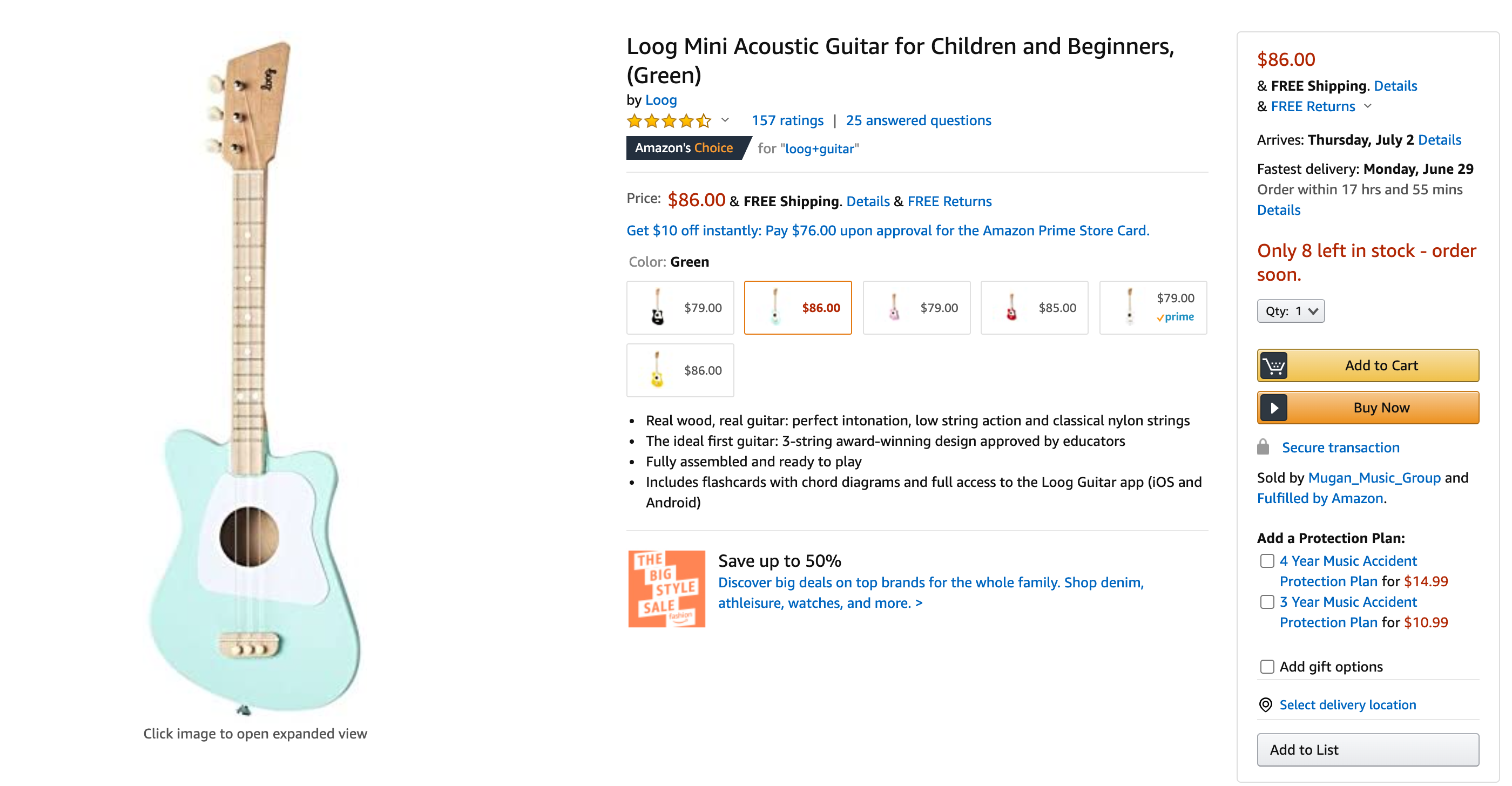

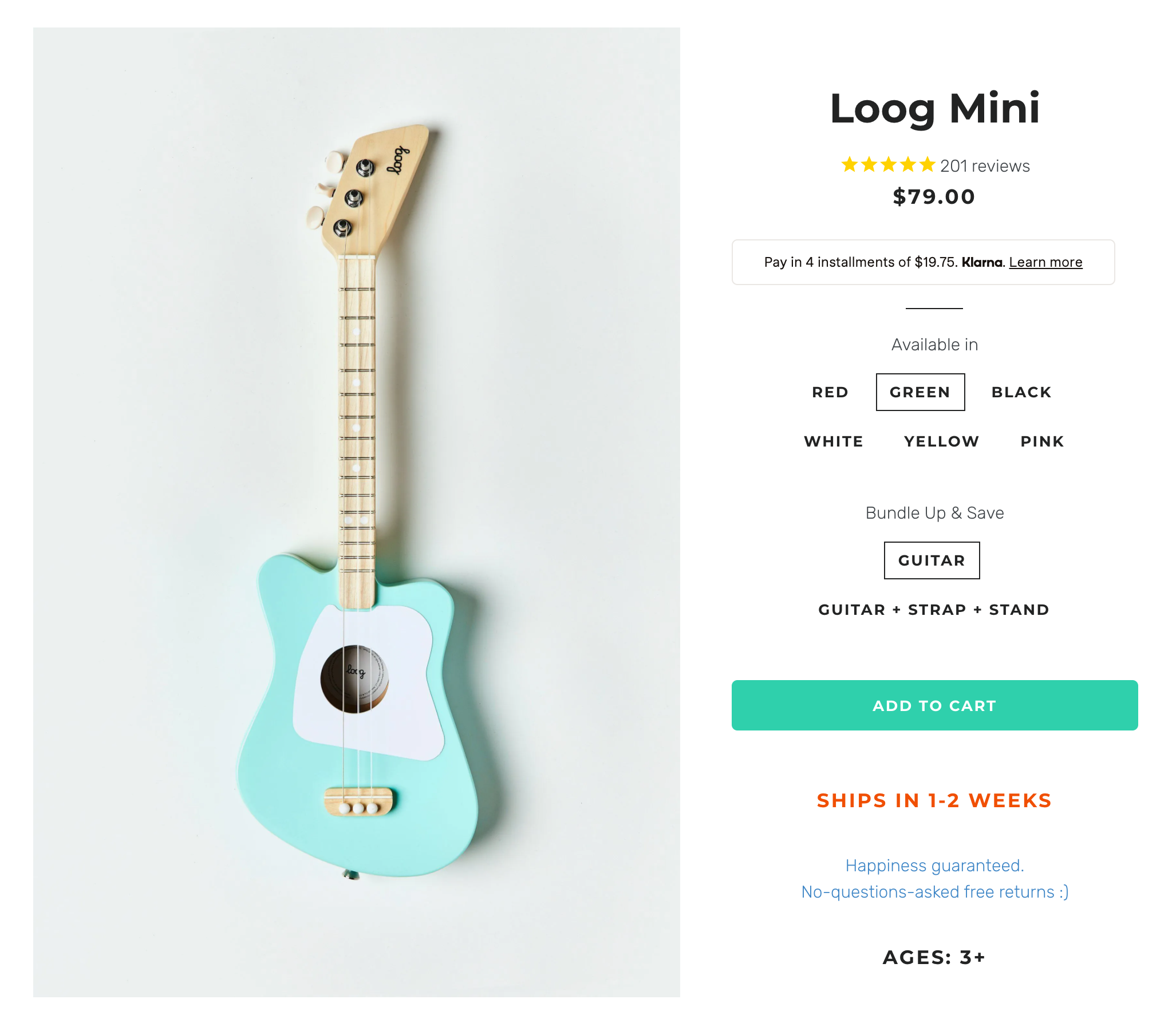

Now if we look at Loog—who makes awesome music instruments for kids, by the way—we find the absence of that delivery promise. Instead, we see "SHIPS IN 1-2 WEEKS". For customers who want it faster, they will pick Amazon, which means Loog gives up 15% margin.

Loog is a relatively small company, though. So what about large brands with mature storefronts or shipping processes? A similar experience exists.

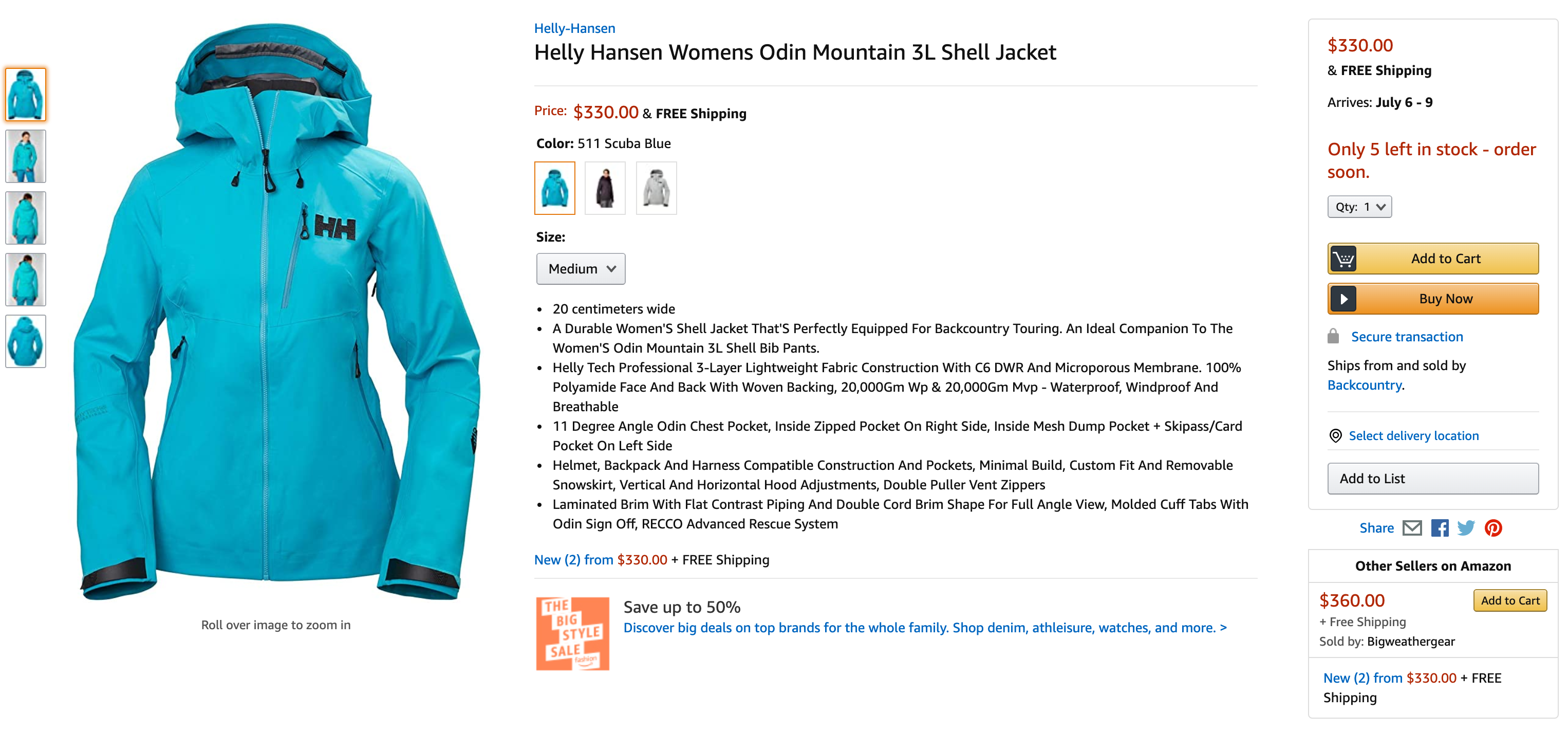

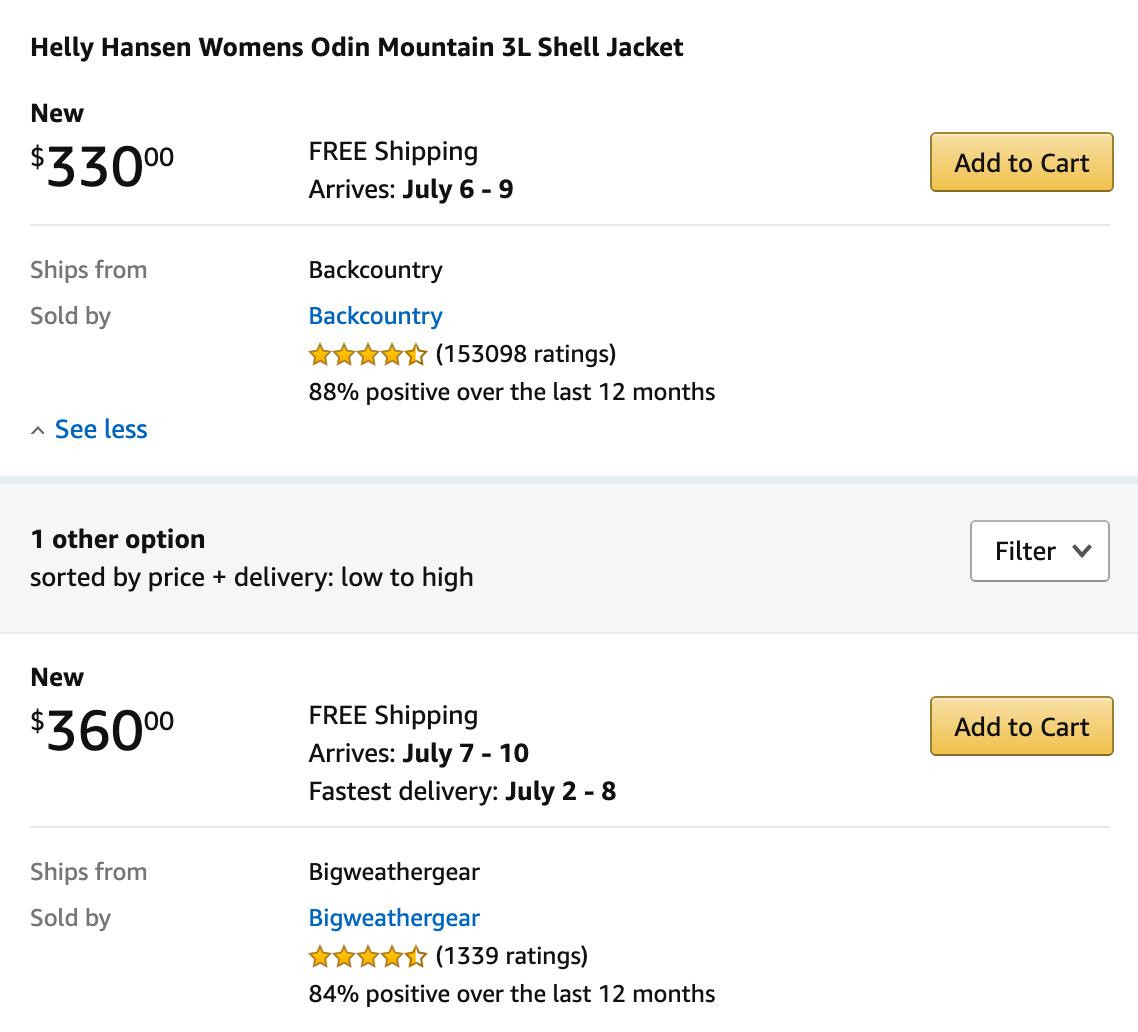

Here we have Helly/Hansen sold on the Amazon marketplace. The default option is via the reseller Backcountry, who does not use FBA, but still gives a delivery date range.

Meanwhile there is another seller, Big Weather Gear, who does use FBA and thus gets a delivery promise.

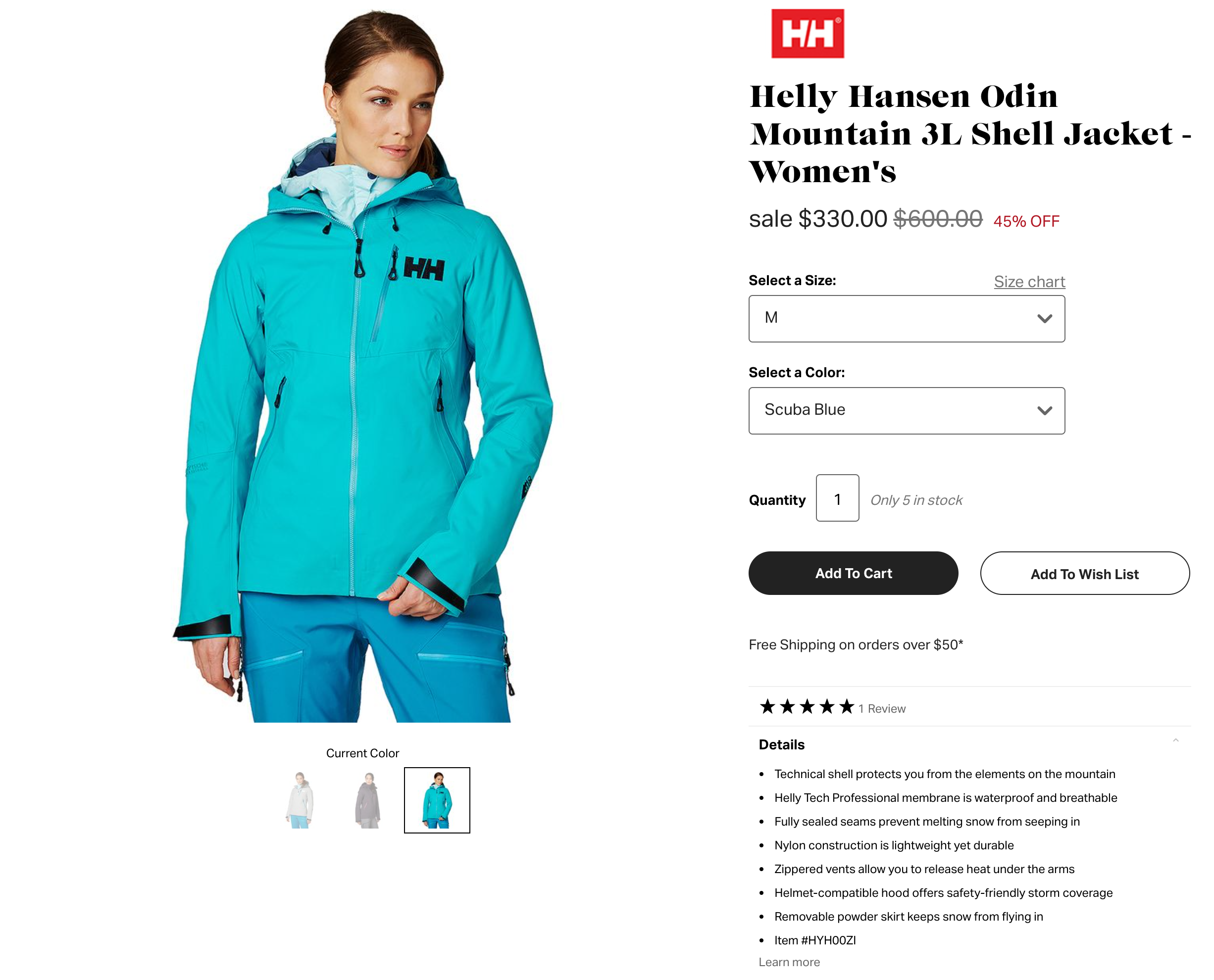

However, if we look at HH's site, there are no estimates at all.

Interestingly, Backcountry is itself a very large ecommerce retailer, with estimated annual online revenues over $500 million making them one of the largest 200 ecommerce sites. If we look at the same product on backcountry.com, we don't see any estimated shipping dates.

Beyond price, it makes sense for customers who are looking for reliable delivery dates to buy from Amazon. Based on our insider knowledge over the years, there is a large cohort of people like this. Other ecommerce leaders have invested in this idea, too, and they deserve credit for helping shift consumer expectations.

Here is how Walmart handles it: Simple, effective, and to the point.

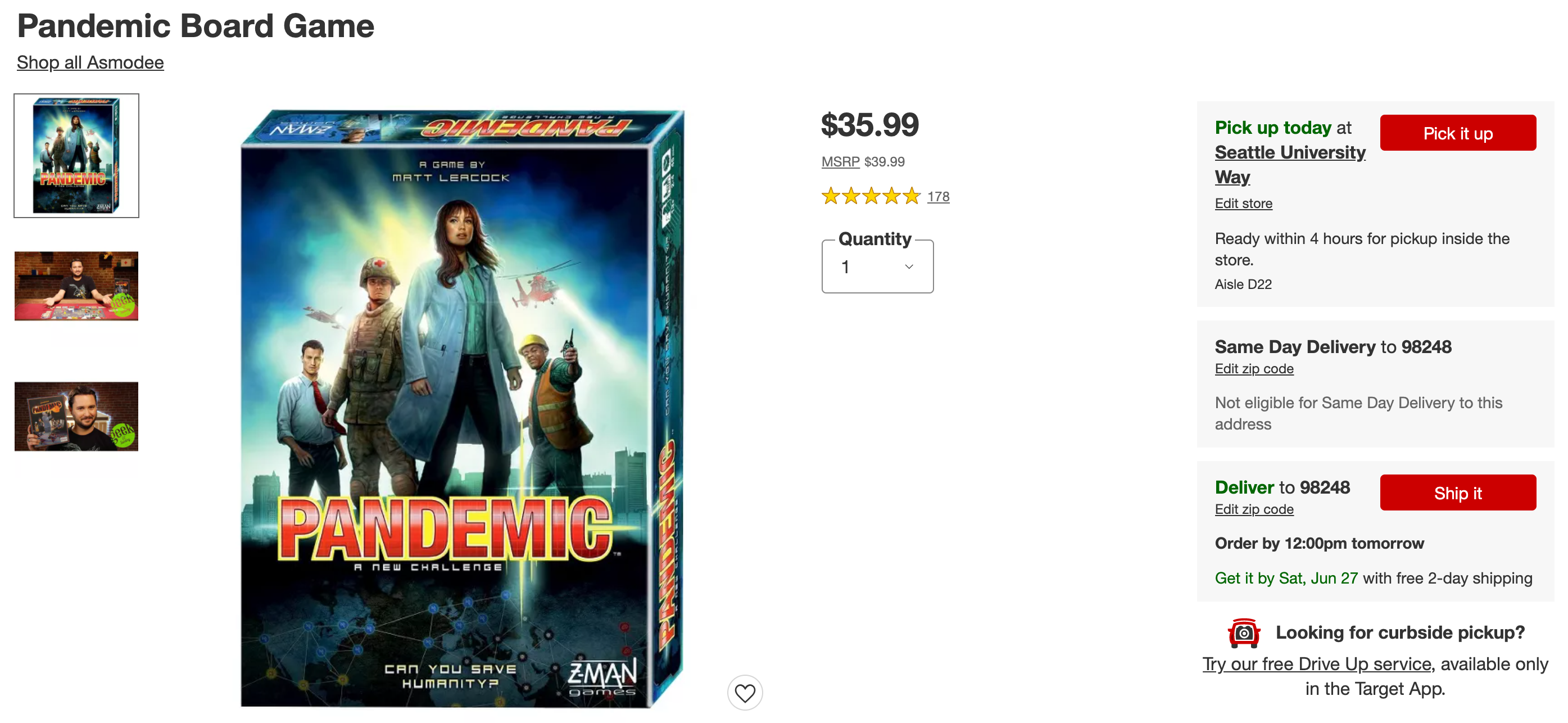

Target is even more aggressive with delivery promises for fast shipping, in addition to providing basic free shipping.

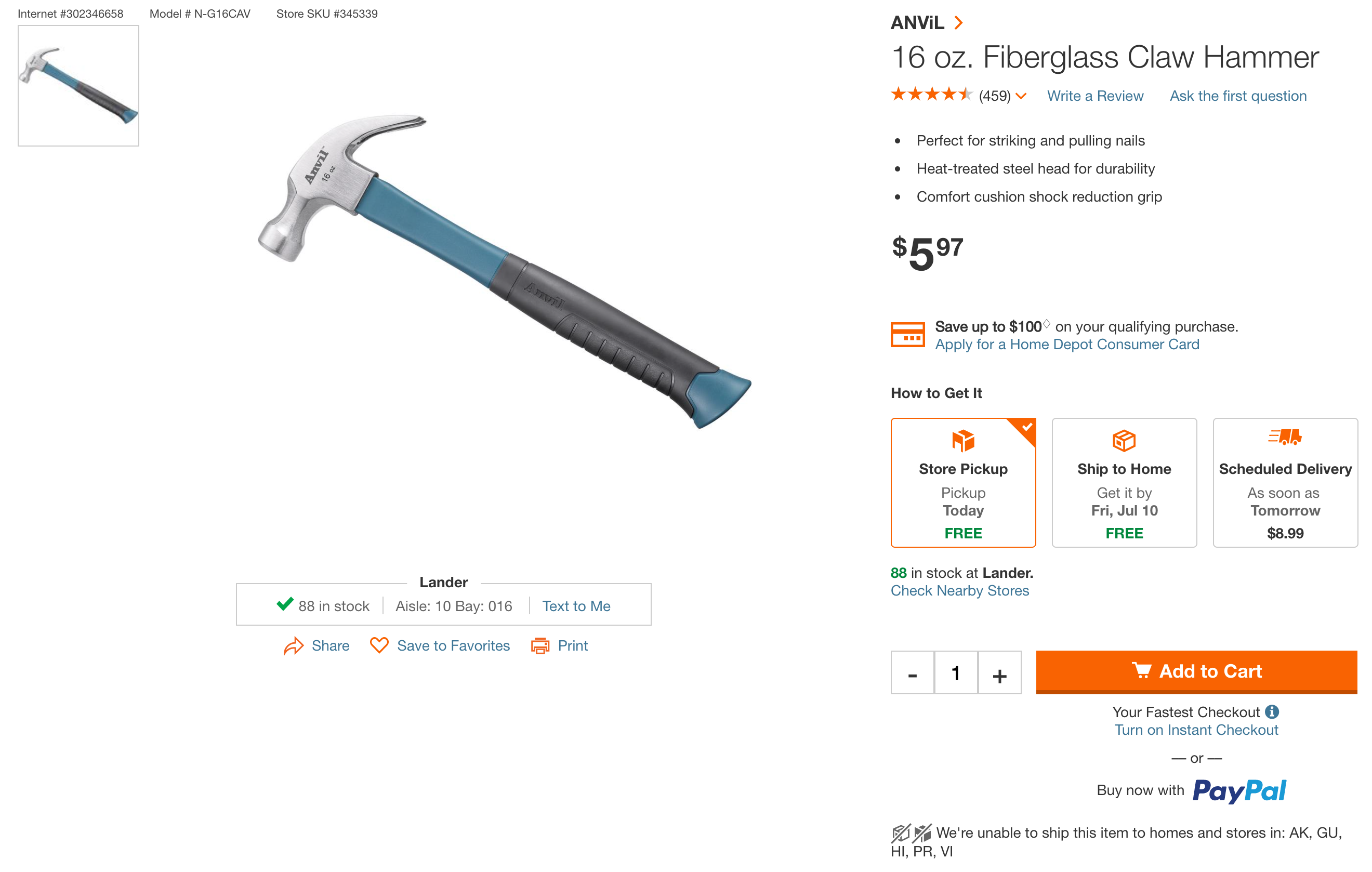

And perhaps the company with the most rapid innovations lately is Home Depot, who not only display estimated delivery dates, but has done an excellent job of bringing in ship-from-store and curbside pickup.

Implementing estimated delivery dates is a challenge

Any company that presents an estimated delivery time will experience better conversion and loyalty. So why doesn't every store do it?

The screen real estate for displaying a simple date is small, yet the technical requirements behind the scenes are huge. A real-time, SKU-specific estimation displayed on a screen requires integration with the following systems:

- Frontend (Store, like Shopify or Magento)

- Inventory

- Fulfillment

- Transit Management System (TMS) / carrier network

- Policies

Shifting a company's internal processes towards customer experience will require changes to supply chain metrics, data, and culture. Practically, it expands the operations team’s area of responsibility to measure and monitor all stages of the shipping process. In most companies, this is a major change from just getting a high-level monthly metric of missed SLAs in the fulfillment centers (FC).

A delivery promise provides a unique advantage in the form of merchandising your supply chain. We often find ecommerce partners actually provide faster speeds than they advertise, missing a major opportunity. Customers who are geographically close to their fulfillment centers will receive the order in two days, even with economy shipping methods.

Without the promise you lose the opportunity to merchandise that speed. Faster delivery times can improve conversion by up to 10.5%, according to a 2024 report by Coresight Research.

Anchoring your processes and metrics on promises also gives you the ability to optimize your processes within the overall EDD. Let’s take the simple example of a subscription where you’ve established a monthly delivery for the customer to receive their product. If later on, you are able to identify a cheaper shipping method that takes longer, you have the ability to just ship the customer's package earlier and still hit the estimate.

For older companies, those systems are usually managed with older fragmented software, so any innovation requiring interoperability is difficult and expensive to set up. For newer companies, no real platform concept exists to connect all these systems, so they are left with fragmented spreadsheets instead of fragmented enterprise resource planning (ERP) systems or warehouse management systems (WMS).

How to implement reliable delivery dates

When implementing reliable delivery dates, the first thing to know is the destination ZIP. If you have a user account system set up, you can pull the ZIP from the customer profile. If the user isn't logged in, you could check if a previous order had been made and saved to a cookie, which can pull the ZIP from that previous order.

Lastly, you can assume the ZIP based on checking the user's IP address, but to ensure accuracy, you may need to request the user enter the destination ZIP on product pages before showing a projected date. The next thing needed is the SKU. Your frontend store will know the SKU because the user is viewing the product detail page for that SKU, so that’s simple.

From there, the front end makes a call and sends those two data points to the inventory management system to know how many items of that SKU are left across which FCs.

The inventory management system now knows the SKUs and the destination ZIP, but the origin ZIP is required to estimate a delivery date. It’s easier with one FC, but as soon as you have two or more FCs, the origin ZIP decision gets much harder because you must choose which FC to ship from. That’s not as easy as you’d think for the following reasons:

- Inventory levels matter, and your policies and processes around rebalancing have to come into play

- Carrier methods might be different based on the regions you’re servicing and is even more pronounced if you use local carriers or last-mile delivery partners in specific urban centers

- Displaying an EDD during checkout, if an order has more than one SKU, is exponentially harder because analysis must happen with all those SKUs simultaneously

- Package cartonization (dimensions, weight) matters for shipping method and policy assessment

Consequently, the next step is to cross-reference shipping policies and carrier contracts with SKUs and FCs. Policies are usually set monthly based on rate sheets and thus are static. However, that approach can impact the probability of precision, so it's best to move that to real-time rate analysis. A TMS that supports real-time data is ideal.

Given all these inputs, the system then runs an algorithm to determine the most precise delivery date available. The result is returned back to the frontend store, which then displays the information back to the consumer.

Discover how you can future-proof your supply chain with machine learning and AI.

Delivery date promise: Key plays

When it comes to providing an upfront shipping date to customers, the challenges are multidimensional and get increasingly complex, with more FCs, SKUs, carriers/methods, packaging options, and shipping policies in your system.

Here are three plays to keep in mind:

1. Managing trade-offs

How do you pick an EDD? Do you pick the cheapest option, the fastest, or somewhere in between? The answer is that the date picked will always be based on tradeoffs, so it’s up to you and your company to decide where you land on the spectrum.

In general, it’s best to optimize towards returning the fastest projected delivery date, as that is a more marketable value. Customers who want things fast or by a specific date are actively looking for that when considering a purchase. Then, you can allow customers to move back down towards a cheaper or free shipping option if they value cost instead of speed.

2. Prioritizing real-time results

Delivery dates need to be determined in real-time. This play doesn’t work well going off of historical or static values, e.g., always displaying a date three days out because your policy is “We ship everything 3-day ReadyPost” or something like that. The complexity of inputs going into the estimated date is too immense to rely on static values.

3. Factoring cut-off times

Managing the latest time that orders can be made on a given day is important to improve precision. For example, if today is Tuesday, don’t include Tuesday in your estimated time if the order is being made at 8 PM local time to the FC shipping the order.

Fulfillment metrics you need to track

The key to optimizing your promise is managing and consistently reviewing and drawing insights from detailed shipping analytics. These include:

- Accuracy: Log all displayed estimated dates. Connect a displayed date with an order placed, then track when the order was received via carrier APIs. Check if the date delivered matched the estimate, and track a variance either way. Industry best practice is to be over 90% accurate.

- Conversion percentage: Log if an estimated delivery date was displayed for a given order. It’s easy to do an A/B test to see its effectiveness. Industry reports show conversion should increase between 6%-12%.

- Speed/cost balance: When determining an EDD, it’s helpful to log all possible dates that were determined for your given policies. For example, maybe the fastest date was two days, but three days was $5 cheaper. You could have potentially saved the money while still leading to a conversion if the customer was fine with waiting an extra day.

Make delivery promises more intuitive with Shipium

Adding a delivery promise is a play that Shipium was built to support. We provide an API that customers call, sending us their product and customer information for a given SKU.

We then return an estimated delivery promise with precision. Enterprise shippers confidently display that date in their storefront interfaces, such as product detail pages or cart checkout flows, helping drive purchase decisions.

Setup for our shipping optimization solutions is easy and only needs to happen once. You set up the FC network information and shipping policies, and if those ever change in the future, it’s very easy to update and adjust. We give a JavaScript snippet, which is easily embeddable and has thorough documentation.

Our API is based on the analysis of all the complex inputs discussed above. Fine-tuning it to be precise and accurate based on our experience building this at Amazon and Zulily.

Book a demo today, and see how Shipium EDDs can help your enterprise boost conversions and deliver a better shopping experience.

Frequently asked questions

What is a delivery promise?

A delivery promise is a commitment a retailer or ecommerce business makes to deliver an order within a specific timeframe. These estimates, usually provided before a purchase decision, set expectations and affect the overall customer experience.

What is the importance of keeping your delivery promises?

Keeping the delivery promises you make at the time of purchase is crucial because it helps:

- Build consumer trust: When your customers receive their packages exactly when promised, it establishes reliability and credibility, leading to repeat purchases and recommendations.

- Reduce customer service workload: Meeting delivery promises significantly decreases day-to-day order inquiries, freeing up resources within your support team.

- Protect your brand reputation: In an era of social sharing, delivery experiences directly impact how consumers perceive your brand. Negative delivery experiences can quickly damage your reputation across review platforms and social media.

- Avoid unnecessary costs: Missing delivery promises often leads to expedited shipping, discounts, or other measures that affect profit margins. Consistent delivery performance protects your bottom line by eliminating these unexpected expenses.

How accurate are delivery promises?

The delivery promises given to consumers can vary in accuracy depending on multiple factors outside your control. For example, carrier performance can dramatically fluctuate seasonally and by geographical location depending on your last-mile delivery partner.

Other unforeseen circumstances that can impact promises made to customers include:

- Weather events that can delay or restrict delivery

- Carrier capacity issues related to holidays

- Logistical challenges, such as inventory placement

While traditional estimation methods use historical averages, modern systems with real-time tracking provide more reliable predictions, improving customer experience by setting more accurate expectations about when packages will arrive.

How can ecommerce companies maintain their promised delivery dates?

Several key strategies can help ecommerce companies ensure they deliver on time, every time:

- Implement robust inventory management systems that provide real-time visibility

- Partner with reliable shipping carriers and establish clear service level agreements

- Create realistic buffer time in delivery estimates to account for potential delays

- Invest in technology for better tracking throughout the fulfillment process

- Proactively communicate shipping delays to maintain customer trust

- Monitor performance and adjust estimates based on delivery data

By implementing these practices, ecommerce companies can build a reputation for reliability that sets them apart from competitors while creating positive customer experiences that drive repeat business and loyalty.

See how Shipium’s ecommerce shipping software can help you keep your delivery promises.