Negotiating Carrier Rates

If outbound shipping isn’t the top operational expense for ecommerce businesses, then it’s always second or third. Few areas have more meaningful impact on margin and profitability than reducing outbound shipping. There are many tricks to reduce shipping costs (check out our other plays), but carrier contracts are a key contributor. Getting low rates at the onset of the contract is a crucial exercise.

This playbook will walk ecommerce operators through the best practices for negotiating carrier rates to reduce overall spending.

Who is this playbook for?

Read this if you are in charge of establishing contracts with shipping carriers and want to know how to negotiate shipping rates to secure the cheapest per-parcel pricing possible.

The challenge of carrier rate negotiation

Many difficulties exist when it comes to carrier rate negotiation. Almost all problems can be summarized by (a) purposeful complexity, and (b) asymmetric data giving carriers an advantage over you. We’ll break down the problems in more detail below.

Overly complex contracts

Negotiating carrier rates is confusing — at least it appears that way. The reason is complexity. The more variance with package dimensions or weights, package types, geographies, fulfillment locations, and time requirements, the harder it is for you to create consistent processes and policies around static pricing.

Carriers know this, which is why they charge a premium to eliminate complexity which can enable companies to deploy an easier-to-manage static policy (e.g., “Use USPS ReadyPost 5-day for everything”) to make your life easier. Here are common negotiation tactics you will hear from a carrier rep:

- “We will give you this special price if you go with this single shipping method.”

- “Use us for all your shipping, and we will give you a discount once you hit a high volume.”

- “Sign this two-year contract to lock in a price so you know it won’t change on you.”

- “Use this discounted rate for this type of parcel profile, and you’ll save more compared to any other option.”

But all carrier rep tactics are designed to lock you into their ecosystem at a price higher than you realize and lock you out of competitor offerings. The result? Higher than necessary shipping prices.

A lot of ecommerce companies land here because it’s simply too complicated to manage multiple contracts, and because they don’t have scalable means to automate shipment selection across those contracts order-by-order because of the high amount of variance mentioned above.

So, the first rule to take into any carrier negotiation is there is no universal best rate or method, only the best methods for specific profiles. This rule is the basis of your negotiation process.

Inconsistent carrier contract terms

If you accept that shopping carrier rates is smart, the next challenge is found in the inconsistencies between contract structures. How much does a carrier cost vs. a competitor? If contract terms aren’t similar between them, comparing their unique options becomes difficult.

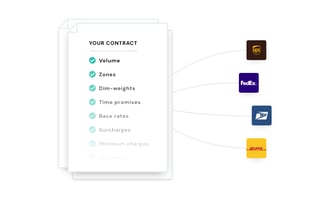

Ultimately, you want to cut through the noise and annotate these four properties which are found in every contract across any carrier.

- Base shipping rates: The per-package rate across zones and dim weights. The heavier, faster, and farther the shipments, the more it costs. Tends to go up with lesser volume, and down with more volume. All carriers have published “off the street” rates, but almost everyone, including you, will negotiate your own rates from there.

- Minimum charges: All carriers set a floor of how much they will charge. You pay the higher value between this minimum charge or the computed charge.

- Dimensional weight (dim weight) divisor: Dim weight is how carriers standardize across size and weight for easy computations. Multiply the length, width, and height, then divide by the dimensional divisor, which is a value currently hovering around 139 for all carriers. If the dim-weight is higher than the actual weight then you are charged for that instead.

- Surcharges / Accessorials: All carriers have aggressively added new charges year-over-year as a means to increase margin or better account for their own costs. This includes fees like “Delivery Reattempt Charge” or “Oversize Charge”. Clearly you want as few of these as possible, but if they exist, the goal is to compare the definitions across contracts and compare them to your shipment profile.

Asymmetric data for for negotiation

Carrier sales reps often have some incentive around increasing margins generated per contract. They do this by having access to more data about your business than you have. Understanding your typical parcel size and weight, zone map, time requirements and how it fits into their network gives them an upper hand to devise a scheme that looks good to you on paper, but may not be in your best interests.

Here’s an example:

You are offered an enticing flat fee for US-wide shipping. The flat fee insulates you from long-zone shipments which spike up. But you already built a strong FC network on both coasts, conceptually eliminating most long-zone shipments. Consequently, you would have been better off declining the flat fee and negotiating for better rates in Zones 1-4 as almost all orders will be shipped based on those shorter zones.

What type of data makes up a “shipping profile” which gives carriers the upper hand?

Your shipping data generally consists of these points:

- Yearly shipping volume

- Bottom line spend per method

- Surcharge (accessorial) fee volume and total spend

- Dimensional weight

- Zone and weight distribution

- Timing (method) selection distribution

You need this data yourself to understand where you can negotiate.

Contract ownership

The last problem is the confusing landscape of who owns the contract. You could in theory do any of the following:

- Create an account directly with a carrier.

- Use a 3PL who has a contract with a carrier and resells those rates to its tenants.

- Go through an aggregator who has a very low negotiated price with a carrier and resells it back to many companies. (Kind of like how a Group Purchasing Organization, or GPO, works in healthcare.)

- Hire a consultant who negotiates on your behalf and then owns the contract and resells it back to you. Like a niche version of the aggregator.

- Work with your ecommerce store platform of choice, e.g. Shopify, who has a contract and resells those rates to its customers.

- Approach a software-as-a-service vendor who, much like the last several options, has a negotiated rate with a carrier and resells the rate as a part of its software package.

Whew! That’s a lot.

The answer is there is no best route, but there are principles you should prioritize:

- If you plan to scale as a business, building the internal muscle and expertise of building relationships directly with carriers is an important thing. It will pay back dividends in the future. You may discover that your best option is still to use your 3PL’s rates, but you are better off being sure of that than assuming it!

- Anything that isn’t API-driven isn’t worth working with.

- The more options you incorporate, the better as you can use arbitrage across rates to find the best one.

What matters to ecommerce?

With the common problems laid out, the final point to highlight centers around the unique business models of ecommerce. Most companies are retailers who ship smaller parcels. There certainly are exceptions, like appliance vendors or flooring marketplaces who work with specialty freight or LTL carriers, but most ship smaller and lighter parcels from fulfillment centers (FC) to residential addresses.

As a result, the business outcomes that matter are speed and cost of delivery because consumers generally want either a fast shipping option, a free shipping option, or both if they can get it!

Good carrier contract optimization requires you to find the areas of improvement across several dim-weight classes and many zones.

The Plays

As we build out the best collection of plays for negotiating carrier rates, let’s discuss how a typical contract works.

Every package you ship has the following properties:

- Weight and dimensional size, or dim-weight when calculated.

- Fulfillment center address that you are shipping from, which defines the Zones.

- Customer destination address, which exists in a Zone relative to the FC chosen.

- Speed requirements, such as “promised to customer in 3 days.”

These properties establish the price of the package to be shipped based on the daily published rates and surcharges of the carrier selected. The agreement in the contract you are using may or may not use additional discounts on top of the published rate.

There are two types of discounts which might be found. First, a guaranteed discount, which can apply regardless of shipping volume, and are a set percentage off of the published daily carrier rates.

Second are the inverse, or discounts that are not guaranteed and are associated to tier-based incentives. They are an additional percentage off the published daily rates based on your shipping volume. The more you ship, the more you save is the idea.

After rates and discounts, commercial carriers like FedEx, UPS, and DHL will apply various surcharges (“accessorial fees”). These are charges contextual to a specific package and delivery, and will only be seen on your invoice after they happen. The fees can also have discounts associated to them too.

Accessorial fees are increasingly becoming the key axis of carrier contracts because it’s the main driver of higher margins. Subsequently, understanding and negotiating surcharges are important.

But it’s really hard because there are a lot of them. For both reference and thoroughness, here are the current list of surcharges found with UPS and FedEx.

UPS

- Additional Handling

- Address Correction

- Chargeback for Consignee Billing Shipments

- Dangerous Goods – International Dangerous Goods

- Hazardous Materials

- Dry Ice

- Delivery Area Surcharge

- Delivery Reattempt

- Destination Outside Service Area

- Extended Area Surcharge

- Large Package Surcharge

- Missing/Invalid Account Number or Refusal Fee

- On-Call Pickup Area Surcharge

- Over Maximum Limits

- Oversize Pallet Handling Surcharge

- Package Tracking, Tracing and Refund Requests

- Pickup Area Surcharge

- Remote Area Surcharge

- Residential Surcharge

- Special Handling of Undeliverable Shipments

- Undeliverable Shipment Surcharge

FedEx

- Accessible Dangerous Goods

- Additional Entry Line Items Fee

- Additional Handling Surcharge

- Address Correction

- Advancement Fee/Disbursement Fee

- Change of Air Waybill Charge

- FedEx Ground Alternate Address Pickup

- FedEx Appointment Home Delivery

- Broker Select Option Fee

- FedEx Ground Call Tag

- FedEx Ground C.O.D.

- FedEx International Controlled Export

- Courier Pickup Charge/On-Call Courier Pickup Charge

- Delivery Area Surcharge: Alaska Commercial

- FedEx Date Certain Home Delivery

- Declared Value

- Delivery Reattempt Charge

- FedEx Delivery Signature Options

- Dimensional Weight

- Electronic Export Information Filing Fee

- Entry Copy

- FedEx Evening Home Delivery

- FedEx ExpressTag

- Extended Service Area Delivery

- Extended Service Area Pickup

- Fax or Call Fee

- Prior Notice for Food and Food Products

- Hazardous Materials

- Inaccessible Dangerous Goods

- Inside Delivery Charge

- Inside Pickup Charge

- International Out-of-Delivery-Area Surcharge

- International Out-of-Pickup-Area Surcharge

- Live Entry Processing

- Metro Service Area Delivery

- Metro Service Area Pickup

- Missing or Invalid Account Number

- Northern Canada Surcharge

- Oversize Charge

- Payer Rebilling

- Pickup Charge (FedEx International Premium)

- Reroute of Shipment

- Residential Delivery Charge

- Residential Pickup Charge

- FedEx Email Return Label

- Return On-Call Pickup Surcharge

- FedEx Print Return Label

- Saturday Delivery

- Saturday Pickup

- Other Special Brokerage Processing

- Storage Charge

- Weekly Pickup Fee

Add it up, and you are billed based on these components for every shipment and delivery made. With this in mind, let’s look at some strategies.

Importance of benchmarking data

You lose the negotiation if you lose the asymmetric data game. Carriers will know averages for a company your size and volume, with shipping profile and zone distribution mix. They will never lead with those averages. Your job is to benchmark comparables to your company so you know what to ask for.

There are a couple ways to get this information. The first is to work with an independent third party negotiating firm. These groups have data across multiple clients and can share between them. The bigger, the better.

The second is to log your shipping options over time, order-by-order. Assuming you have multiple carrier contracts, you can compare and log options at the time of selection. Eventually you will get enough visibility to inform you of what a normal profile looks like for your company.

Create a shipping matrix

Build a multi-dimensional matrix by creating separate tables and overlaying the data. Let’s walk through it.

First, chart out your “to” zones as an axis. For ecommerce, it’s usually Zones 1-8. Note that almost all carriers combine Zones 1 and 2 into “Zone 1/2” presumably to combine the price of both.

Let’s assume you have two FCs, one on the East Coast and one on the West Coast, thus making it so most shipments are in Zones 1-4, with Zones 5-8 being more long-tail situations.

Then, chart out your typical package weights as another axis. Relatedly, this is where the common dynamics of ecommerce business models will show up. Most companies will be charting weights under 5 or 10 pounds. Few will be charting above that. Alternatively, if your business model requires many different dimensional sizes of boxes being shipped, you could chart this based on dim weight instead of weight.

Next, retrieve historical shipping data and chart out shipment volume per cell.

Repeat the process with the same axes, but now chart out historical cost-per-package.

With this matrix in hand, you can now look for patterns.

Apply carrier contract optimization across multiple shipping profiles

Taking our matrix above, another strategy is optimizing certain profiles for certain contracts.

For example, you might be able to negotiate an excellent rate with USPS for smaller packages under 1lb. while securing a different rate with FedEx for packages over 1lb.

Or you might notice that your FC locations make for an optimized split by zones, where a really great rate for USPS ReadyPost can be used for Zones 1-4 and FedEx Ground for Zones 5-8.

Or maybe it makes sense to optimize by time, and you get the good rate for FedEx 2-Day to service all dim-weights and zones quickly, and USPS ReadyPost for everything else where shipping was free to the customer at purchase.

And so on. Slicing by shipping profiles are one of the best ways to minimize shipping costs. This is more true the larger your volume and diverse your profiles.

Engage with multiple carrier contracts

Working with multiple carriers gives you leverage in a few key areas.

First, the reason to create multiple shipping profiles is because you want to pair them with multiple carrier methods to reduce outbound shipping costs via arbitrage. Often the best method to match a given shipping profile is found with a separate carrier.

Engaging with multiple carriers has other benefits during negotiation, too.

A rep will often push for exclusivity as a means to get the best carrier rates possible with them through non-guaranteed volume discounts, and thus save the most money. (They then put the volume threshold to get that discount at what they project your maximum volume to be, thus indirectly securing the likelihood of using them exclusively.)

While it’s true that the best rate with that particular carrier would be if you got an additional volume discount, it’s not true that it’s the best way to save the most money because the additional volume discount you would receive will almost always be worse in aggregate than if you shopped shipments between multiple contracts.

Knowing this, if you have other carrier contracts in hand, it gives you a stronger negotiating position when asking for other benefits instead of a volume discount. In particular, with the other tips above, you can isolate a specific area of the contract—e.g., better rates for packages over 1lb.—that you know to benefit you in aggregate.

Having an established relationship with one carrier will give you a stronger negotiating position with a different carrier. If you only ever work with a single carrier, you lose an enormous amount of leverage, and your deals overall will be worse than by working with multiple carriers. Carriers react to a loss in volume, so demonstrating that threat with a working relationship with another carrier is one of the best things you can do to lower your total costs.

Skip the RFP

The typical way to open a contract negotiation is to send an RFP to a carrier. This is becoming less of a good idea, especially if sending to an incumbent carrier in which you already have a contract in place.

It’s much better to do your homework beforehand, and isolate the specific areas you want to gain an advantage. You can control the conversation and gain the initiative on what you want to negotiate. Going the RFP route opens up the entire contract for negotiation, which only adds time, confusion, and opportunity for reps to distract you.

Position a change in the company as a reason to negotiate

Ultimately, what matters to carriers is volume because they have poor margins and only make meaningful profits at scale. (Both FedEx and UPS make less than $1 per delivery on average—literally pennies. Talk about razor thin margins!)

Thus, carrier reps operate under two modes. When acquiring new customers, they are looking for as much margin as possible. When retaining customers, they are looking to ensure they don’t lose your volume.

When renegotiating an existing carrier contract, the best approach is to signal that an internal change has happened in the company, and there is a strong chance volume will shift to another carrier unless an area of the contract can be improved.

Here’s a simple opening statement that will frame the conversation well for you:

“Dear UPS Rep: We recently hired a new COO who has worked exclusively with FedEx in the past. She would like us to consider switching to FedEx as the preferred carrier. We are establishing a contract with FedEx, but wanted to come to you as the incumbent to talk about comparisons and options.”

The ideal standard for ecommerce

Okay, we have covered a lot. So, what’s the summary for the best approach for an ecommerce operator like you?

- Make sure you have as much data about yourself as the carrier as on you

- Make a shipping matrix along with multiple shipping profiles based on that data

- Isolate specific areas across shipping profiles that will have the biggest impact on operating cost or performance, and seek out the best carrier method for that profile

- Lean into the complexity of securing and managing multiple carrier contracts

- Optimize across carriers for at least one fast option for customers, and one free option for customers

- Readily renegotiate and play carriers off each other

Gotchas

Understand contract durations

There is a balance between the value of short-term and long-term contracts. One isn’t necessarily better than the other, but rather context matters. For example, during the COVID-19 pandemic, shorter quarterly contracts were more helpful because of how much rates fluctuated. Meanwhile, locking in amazing terms and conditions for a specific shipping profile might make sense for two years if you know internally that volume to that shipping profile is set to explode.

Watch for minimum spend misalignment

You may be enticed by a 50% discount on a certain profile, but if the average rate for that Zone/Dim-weight profile is $10 and the minimum charge is $7, you will not get that 50% discount. (50% off $10 is $5, but the minimum charge is $7, so you are never getting more than a 30% discount.) The missed $2 of savings multiplied by millions of packages is a lot of money.

It’s an extreme example, to be sure, but it highlights the type of missed opportunities a minimum spend can introduce.

Avoid any and all rebates

If you have to choose, don’t do rebates, do discounts. Normal consumerism here: You want the discount applied before the invoice goes out to you and not be a liability that is on you to resolve and collect.

Protect your rights

Carriers will want you to waive many rights. A good example is the right to the “on-time or it’s free” guarantee. Always fight to never lose these rights for two reasons. First, rights like these give you fair financial protection. But more indirectly, often waiving these rights will eliminate additional data or tools available to you for reporting. Remember that asymmetric data is how they gain an edge, so don’t give it to them.

Metrics

- Cost-per-package: Track this, and add as much granularity for pivot possibilities as possible (rate per zone, etc.).

- Cost-per-pound: Same thing, but measure per pound.

- Cost-per-dim-weight: Same, but per dim-weight.

- SLA performance of carriers: Track how often carriers don’t deliver at the times they say they will per the contract, as that becomes negotiating leverage.

- Zone distribution: Breakdown of package volumes, costs, performance, etc by zone.

- Logging options at time of selection: Each time you make a shipment selection, log the options that were available to you at the time.

How Shipium Does It

There are a few ways Shipium helps in negotiating carrier rates.

Visibility

The Delivery Visibility service gives carrier performance data across ZIP codes and methods. Understand SLA performance and zone distribution.

Carrier Selection

The Carrier Selection service analyzes shipping options based on contracts, service levels, and policies instituted by you. It takes care of the real-time decision-making across multiple shipping options that captures the massive ROI potential of working with multiple carriers in the first place. Without a capability like this, it’s difficult to find the comparison advantages, or logic-based policy decisions, in real-time.

Book a demo today and discover how Shipium can your business achieve carrier contract optimization.