Complete Ecommerce Supply Chain Guide

Complete Ecommerce Supply Chain Guide

In this guide you’re going to learn how to structure a modern ecommerce supply chain with a focus on the customer. We wrote it in digestible chunks making it easy to see how it all connects. Textbooks are for MBA courses and five-paragraph blog posts aren’t useful. Instead, we thread the needle with comprehensive yet condensed insight you won’t want to miss.

In fact, many of these insights have helped us in the past. Shipium’s team consists of former Amazon and Zulily veterans. Many lessons learned there made their way to how we picture modern supply chain in ecommerce.

If you sell online and want to understand how to optimize your supply chain, this guide is for you.

The difference between ecommerce and brick-and-mortar supply chains

Let's start with an obvious but important point: An ecommerce business is fundamentally different from brick-and-mortar (B&M), which means the ecommerce supply chain management is fundamentally different, too.

Some components of the supply chain are more important while others might not exist. For example, fulfillment centers (FC) are designed differently for ecommerce delivery, while distribution centers (DC) can be cut out entirely because there is no requirement to deliver goods to a storefront.

A few more key differences:

- On average the number of SKUs for ecommerce businesses is higher than B&M models, which means more variability with processes and packaging.

- Ecommerce inbound logistics focuses on optimizing allocation, whereas B&M inbound is about uniform distribution to DCs and optimizing delivery to stores (over/under stocking).

- Ecommerce inbound logistics can be directly associated with a customer order. For example, Amazon’s “More on the way” message means any purchases of the out-of-stock item will be immediately shipped to the customer when available.

- FC is focused on “single-piece flow” or streamlining picking to sorting to packaging an order.

- Returns are a different experience—go to the store versus print a label and ship back—making reverse logistics very different.

- Service Level Agreements (SLAs) matter more for ecommerce models, as the expectations are different for the movement of goods to consumers.

- Lastly, it’s easier to understand demand for a product that is out of stock due to the digital nature of ecommerce stores, as opposed to an empty shelf in a physical store. This has major impacts on demand forecasting, purchase orders, and allocation.

This guide starts from the orientation that you are first and foremost an ecommerce business.

Supply chain strategy for ecommerce businesses

An ecommerce supply chain strategy is uniquely important. Unlike brick and mortar, the delivery of products is one of the few experiences customers have with your brand. In a physical world, experience is consolidated to store layouts and aesthetics, employees on the floor, touching the product in your hands, checkout lines, etc.

With ecommerce, customers primarily engage with your brand digitally via your site or apps, but secondarily with the delivery experience after purchase. As a result, availability, speed, and convenience all factor into brand experience. The supply chain now has an elevated role to customer loyalty and life-time-value.

Your supply chain plays a strategic financial role, too. Ecommerce models will inherently require less capital expenditure in things like stores and employees, which means both capital and operational expenses within the supply chain become a larger share of total cost, like setting up a new FC (capital) or shipping cost per unit (operational).

With that in mind, reduction in costs has a much bigger impact on freeing up “found money” to reinvest into other parts of the business. This exact strategy is a major cause of winners and losers in the DTC space, in particular, and online retail more generally.

It shows, then, that a modern supply chain with a focus on cost reduction will become a strategic differentiator for sales growth, which doesn’t really happen for brick-and-mortar models at scale.

Key metrics

Your business is shaped by what you measure, so it’s critical to get your supply chain analytics right. Smart ecommerce companies aggressively prioritize customer-centric metrics.

The most important metric is order-to-deliver, sometimes called click-to-deliver.

No metric better represents what matters to the customer than how soon they will get the product after they click to purchase.

Traditional metrics like time-to-pack or click-to-ship are useful diagnostic tools, but should never be the priority measurements that shape your operating cadence.

Order-to-deliver rolls up all kinds of metrics to give a single view into how well the supply chain is supporting the strategic initiatives of the business.

A few other customer-centric metrics to consider:

- On-time-delivery accuracy: How often do we keep our delivery promises to customers?

- Stock levels: The percentage of stock availability when a customer views a product page is directly related to brand perception and customer happines.

- Performance: WISMO (Where is my stuff?) and WISMR (Where is my return?) are customer experience metrics that are intimately connected to reverse logistics performance.

- Recovery %: Returns are essentially a result of an exception farther upstream. By tracking the recovery percentage, you can gauge how successful your supply chain is performing.

Inventory placement and allocation

You can only ship stuff from where it's located. With that in mind, the decisions around what inventory you place and where you place it makes a major difference to everything downstream.

The big idea: The closer merchandise is to prospective buyers, the faster and cheaper delivery will be. Intelligently allocating inventory across your network will open up the ability to offer fast or free shipping programs.

If you only have 1 fulfillment center in your network, then allocation is simple, but results will be poor. You'll cut off cheap and fast delivery to half your market. Two FCs make a difference, but now you need to decide how to allocate inventory. The following point is going to assume you have 2, 3, or more FCs in your network, even if using 3PLs.

Generally, putting all skews in all locations is a good first pass. If the physical attributes of your product are simple—small, light, consistently the same size—then it might make sense to always do it this way.

As companies grow and their SKUs differentiate, more complex strategies are needed. Generally, most companies should plan allocation like this:

- Take the global forecast for a SKU.

- Analyze buying patterns for the SKU geographically.

- Attach cost structures to where that SKU is placed.

- Calculate the probable cost of storing and shipping that SKU to probable buyers per FC.

- Take those results and split up SKU allocation across FCs based on the outlay.

Inventory management (from a supply chain point of view)

What’s notable about inventory management within ecommerce business models is how much it’s brought into question old ideas. For example, ABC analysis was useful when data was harder to obtain, but with the computing advantage afforded by ecommerce systems, it may not be as useful compared to, say, probabilistic forecasting across all inventory decisions.

Decisions are a good way to think about inventory management. You will be making hundreds, if not millions, of decisions a day—buy more of a certain SKU? In what size? Move that other SKU to a different FC? And so on.

The accumulation of inventory decisions is meant to optimize your position along a spectrum of two risks:

- Holding Risk: Costs of maintaining inventory that isn’t selling.

- Stockout Risk: Lost revenue, or opportunity cost, of not having inventory available when people want to buy it, on top of additional hard costs like idle labor or under-utilized machinery.

The big idea for ecommerce companies: Perfect optimization in the middle is nearly impossible, but you can often get closer than brick-and-mortar models because of the ability for the entirety of the ecommerce supply chain to be interoperable. Buy an inventory management system that is modern enough to take advantage of the extra data available to you across modern partners, and the computational ability to push data-driven decision making.

A major factor to managing these risks, as well as reducing costs and improving customer experience metrics, is the location of FCs and inventory allocation to those FCs. We talk a little more about that below.

Delivery experience

The supply chain is directly responsible for customer delivery experience. Design, and subsequent improvements, can be charted in four categories.

(1) Speed:

Consumers want their products as fast as possible, within reason. Both industry data and our experiences show 2-3 days is preferable, and anything longer than 7 days is a deal breaker. Somewhere in 3-5 days is acceptable for certain goods, but you need to be transparent about the time.

(2) Transparency:

Customers want to know when they will get a purchased good even before they buy it. Transparency and accuracy up front are increasingly critical to cart conversion.

(3) Communication:

Keeping customers updated during and after the purchase is becoming the main memorable interaction that determines repeat purchases. When dates change and a customer doesn’t know, you can say goodbye to customer loyalty.

(4) Cost:

Most customers hate to pay for shipping. You must make a choice on how to handle that preference, and the answer is up to your business. Recommendations: Bake it into the product price, slide some of the “found money” of cost savings elsewhere to subsidize free shipping, or eat it as a part of your margin and consider it an investment.

The culmination of all these points is what we call the Delivery Promise. Customers want a fast shipping option, that’s “free” or cheap, to see the delivery date up front, with good communication along the way.

Optimizing your rate shopping process helps you better meet customer delivery expectations. This involves comparing carriers based on speed, cost, and service requirements for each shipment, ensuring you select the carrier most likely to meet the promised delivery date.

Effective rate shopping can lead to significant savings. For example, a Nucleus Research report found that an electronics retailer reduced its annual transportation costs by $5 million using Shipium's rate shopping engine to streamline their shipping experience.

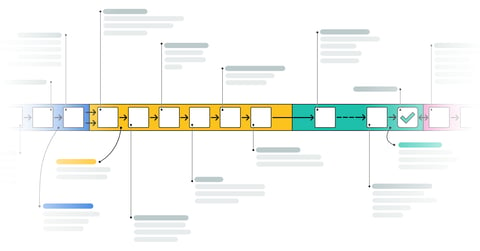

All the links of a supply chain in ecommerce

An ecommerce supply chain prioritizes some components more than others, and sometimes doesn’t even include legacy components. It’s helpful to first study as much as you can. Then the design is ultimately up to you, but here is the best basic design that any ecommerce business can use to plan their supply chain.

Demand forecasting and sourcing

Purchase orders, or procurement, can be managed differently for ecommerce businesses because it has the ability to be more intelligent than brick-and-mortar replenishment due to how ecommerce is inherently digital, with data more often centralized even when across multiple channels.

A few other things to think about:

- Because holding of merchandise is more centralized than across many stores, the standard benefit of volume breaks has an even more pronounced impact on profit. Consider investing in buying more inventory than you would initially expect.

- Lead time still matters but in a different way.

Placement

Initial placement, or “first allocation,” of orders can have one of the biggest impacts on unit costs. “You can only ship stuff from where it’s located” is a top supply chain principles at Shipium, which means deciding on where to locate merchandise has an enormous impact on costs. This insight also contributes to why most ecommerce companies are surprisingly too slow to expand to multiple FCs.

Rule of thumb: Place merchandise as close to the expected customer as possible to realize the maximum amount of savings possible.

More considerations:

- The sooner an allocation decision is made, the less cost allocation will be. This is why predictive analytics and demand forecasting are so intimately connected to first allocation decisions.

- Re-balancing is expensive, so getting first allocation right is so critical. Yet, re-balancing is a sunk cost that is still cheaper at scale than shipping goods from an FC far away from the customer.

FC/3PL management

Picking the right fulfillment partner matters. There are several strategies to consider:

- 3PL companies who work only with ecommerce businesses will typically be a better choice because their design is best aligned with the needs of an ecommerce business.

- Your business is specific to you, which means it’s best to find a 3PL who specializes in your type of business. Some 3PLs specialize in large products like appliances, others specialize in products under 1 lb., while others specialize in fashion and apparel or electronics, and so on.

- The more automation, the better, although don’t over-prioritize or overpay for robotics or AI (yet).

- Interoperability of data matters.

- Returns are a critical piece to any ecommerce business model. Pick a 3PL partner with a strong returns program, whether it be something custom you build, or tight integration with some of the modern returns solutions out there.

Packaging

Packaging is a critical part of the customer experience, but it’s also a major cost center, which means the variance of trade offs are pretty wide. It’s probably the part of the supply chain most contextual to your business’ needs. Some businesses should be totally optimized towards the cheapest packaging possible, while other businesses should have expensive yet experiential packaging. There is no right answer here other than whatever is best for your business, but generally, some trade off in the middle is best.

Because packaging is one of the key moments of physical engagement with customers, it also becomes a compelling area to invest in strategic differentiation. One of the hottest examples, among many, is sustainable packaging. While not only being good for the planet, sustainable packaging is growing in customer preference when making a purchase decision. But sustainable packaging is expensive and requires additional capital and process investments, which is actually a good thing for you.

An old brick-and-mortar company may be too distracted to focus on improving its ecommerce packaging, which gives ecommerce companies an opening to create differentiation.

Carrier selection

It should be easy to pick the fastest and cheapest outbound delivery option, right?

As it turns out carrier selection is a puzzle most businesses struggle with. It becomes one of the key points of the chain where ecommerce models can squeeze out additional cost savings to give the business an advantage at scale versus old brick-and-mortar competitors.

First, get the right contracts in place. Shop around by talking to the carriers directly (UPS, FedEx, USPS, DHL). But also talk with your 3PL partner or other possible partners who might have a contract that gives you even cheaper rates. In general, though, it’s best to not have multiple contracts via multiple parties going at once as it adds complexity to your system, while it is wise to consider multiple contracts with multiple carriers so you can scheme them off each other.

As much as $1/unit can be saved by intelligently selecting carriers during shipment generation. Much of those savings is tied to being close to the customer, which is yet another point to explain why ecommerce companies should invest in at least two FCs earlier than they typically do.

Post-order tracking

Shoppers expect transparency and communication, so the post-order experience is a key factor in determining repeat customers.

One key consideration is how post-order tracking ties into your other systems. It’s not immune to interoperability needs. In fact, we are seeing many retailers look at “digital unboxing” as a key part of packaging (discussed earlier), yet much of the digital unboxing experience requires accurate post-order information via APIs.

Last-mile

Last mile delivery is expensive and difficult, which is why several companies have jumped into the space lately, from incumbents to startups.

Here’s the key point for ecommerce companies: Your specific business model will determine whether to work with incumbents like USPS or new startups. You might be just fine doing normal shipping with a regular carrier. But you might find major cost savings and a better customer experience with a specialty last-mile company like Roadie.

Returns

Returns are a big problem for ecommerce companies. They eat into margin. Consumer behavior has shifted over time, too, as the expectation that returns are free and easy is the norm.

Industry data says that the majority of reasons for returns are retailer faults, but when digging into the numbers, it's more about consumer behavior evolving to expect they can return anything at any time for free, which means they buy a lot at once (usually to get free shipping) and then return what they don't want. So the first thing to consider about returns is that the biggest positive impact is ensuring the process is inexpensive and doesn't cut into margin too much.

Beyond that, ecommerce businesses are especially sensitive to an ineffective returns process that negatively impacts customer experience. Not only are returns expensive, but a bad experience, such as asking customers to pay to ship a return, translates to as high as 81% of customers never returning for a repeat visit, according to a ComScore study.

In short, a few guiding principles around returns has proven to be the best model for ecommerce businesses:

- Offer free return shipping.

- Do not charge a restocking fee.

- Make the return process hassle-free, which could mean including a returns label immediately in the package, or, to save on costs, integrate across partners to make printing a label dead simple on your site.

- Present your returns policy clearly up front on the product detail page, since over 60% (same study) of shoppers check the return policy immediately before a decision to purchase.

Start optimizing your supply chain management strategy

One way to think about it is the classic 80/20 rule: 80% of ecommerce supply chains are consistent across companies so certain best practices can be applied, while 20% are different and specific to the needs of your business model. This guide is meant for the 80%.

Discover how Shipium can reduce shipping costs for your organization. Book a demo today.

Frequently asked questions about ecommerce supply chains

What is an ecommerce supply chain?

An ecommerce supply chain is the movement of goods from the manufacturer or source down through eventual delivery to the end consumer. The supply chain is focused on pairing the digital experience of buying the goods with the physical operations of sourcing, fulfilling, and shipping the products.

How does ecommerce help in supply chain management?

Ecommerce helps create a customer focus in supply chains. With ecommerce, it’s all about the customer and their experience as they are the ones buying the goods on the website or via digital or omni channels.

Turns out supply chains are responsible for a major chunk of the customer experience:

- Ensuring product is available

- Giving delivery promises

- Managing fulfillment

- Handling shipping delivery on time

An ecommerce business model will add a customer focus to supply chains like never before.

What are the advantages of supply chain management in ecommerce?

Ecommerce will further the digitization trend of supply chains and operations. As a digital business model, things like data leverage and flexibility become central to operations. To survive and thrive in ecommerce, supply chains begin to absorb the principles and initiatives of ecommerce to modernize themselves.

What metrics should I track for ecommerce supply chain performance?

For inbound and inventory-related metrics, each business is different but the best metrics to consider are ones that focus on inventory turns and the cost of distribution of goods to your fulfillment centers. For outbound, the best metric to track is “Click-to-Deliver,” which monitors the timing of when a customer buys to when the order is delivered. These are the metrics that matter the most for customer-centric ecommerce business models.

Diagonal thinker who enjoys hard problems of any variety. Currently employee #5 and the first business hire at Shipium, a Seattle startup founded by Amazon and Zulily vets to help ecommerce companies modernize their supply chains. Previously was CMO at Datica where I helped healthcare developers use the cloud. Prior to that I came up through product and engineering roles. In total, 18 years of experience leading marketing, product, sales, design, operations, and engineering initiatives within cloud-based technology companies.